根据ACCA特许公认会计师公会发布的公告,自2016年9月份ACCA考试季度开始,基础阶段技能科目考试(F5-F9)在保留笔试机会的同时正式引入机考形式。另外相关的ACCA考试科目的细节知识点也做了删减和调整,此次大纲的变动主要有两点:1、选择题已经从30-40分提高到60分,2、增加Case新题型。为此中国ACCA考试网为大家梳理了一下ACCA考试科目F5-F9的大纲变动内容,详情如下。

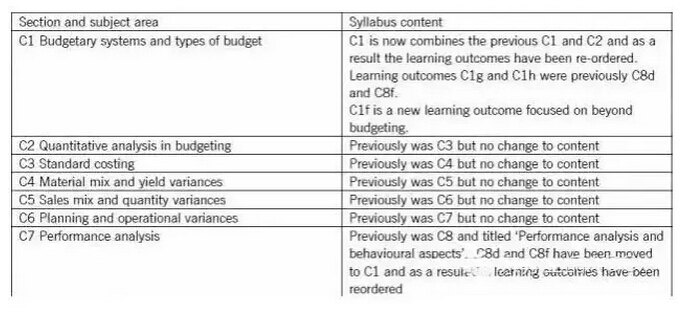

F5(2016.09-2017.06)

F5(2016.09-2017.06)

SUMMARY OF CHANGES

There are changes to the syllabus and these are summarised in the table below.

Additionally the exam format will change in September 2016.Please refer to“Approach to examining the syllabus”in this document.

Approach to examining the syllabus

The syllabus is assessed by a three-hour 15 minutes paper-based examination.

All questions are compulsory.It will contain both computational and discursive elements.Some questions will adopt a scenario/case study approach.

Section A of the exam comprises 15 multiple choice questions of 2 marks each.

Section B of the exam comprises three questions comprised of 5 multiple choice questions.

Section C of the exam comprises two 20 mark questions.

The two 20 mark questions will come from decision making techniques,budgeting and control and/or performance measurement and control areas of the syllabus.

The section A questions and the questions in section B can cover any areas of the syllabus.

Candidates are provided with a formulae sheet.

F6(UK)(2016.09-2017.03)

SUMMARY OF CHANGES

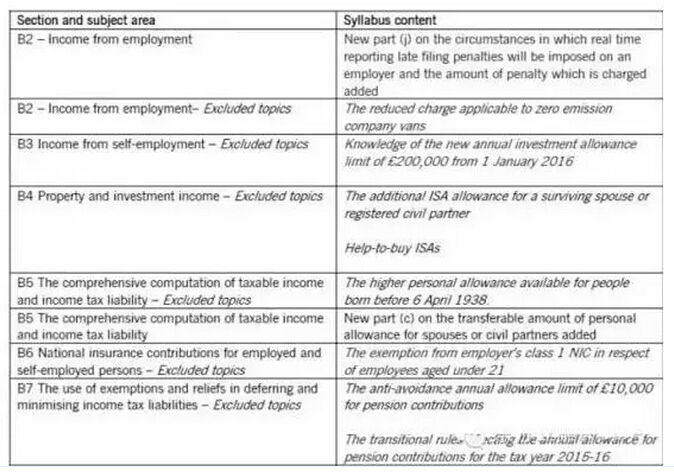

The main areas that have been added to the syllabus are shown in Table 1 below:

Table 1-Additions to F6(UK)

The main areas that have been deleted from the syllabus are shown in Table 2 below:

Table 2–Deletions from F6(UK)

The main areas that have been amended the syllabus are shown in Table 3 below:

Table 3–Amendments to F6(UK)

Additionally the exam format will change in September 2016.Please refer to“Approach to examining the syllabus”in this document.

APPROACH TO EXAMINING THE SYLLABUS

The syllabus is assessed by a three-hour 15 minutes paper-based examination.

The paper will be predominantly computational and all questions are compulsory.

Section A of the exam comprises 15 multiple choice questions of 2 marks each.

Section B of the exam comprises three 10 mark questions which comprise five multiple choice questions of 2 marks each.

Section C of the exam will comprise one 10 mark question and two 15 mark questions.

The two 15 mark questions will focus on income tax(syllabus area B)and corporation tax(syllabus area E).

All other questions can cover any areas of the syllabus.

F7(2016.09-2017.06)

SUMMARY OF CHANGES

RATIONALE FOR CHANGES

Note of significant changes to study guide Paper F7

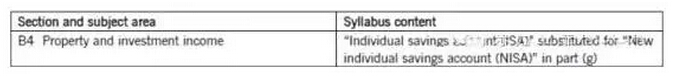

The main areas to be added or deleted from the syllabus from that date are shown in Table 1 and 2 below:

Table 1–Additions to F7

Table 2–Deletions to F7

Additionally the exam format will change in September 2016.Please refer to“Approach to examining the syllabus”in this document.

APPROACH TO EXAMINING THE SYLLABUS

The syllabus is assessed by a three-hour 15 minutes paper-based examination.

All questions are compulsory.It will contain both computational and discursive elements.

Some questions will adopt a scenario/case study approach.

Section A of the exam comprises 15 objective test questions of 2 marks each.

Section B of the exam comprises three 10 mark case-based questions.Each case has five objective test questions of 2 marks each.

Section C of the exam comprises two 20 mark questions.The 20 mark questions will examine the interpretation and preparation of financial

statements for either a single entity or a group.The section A questions and the other questions in section B can cover any areas of the syllabus.

An individual question may often involve elements that relate to different subject areas of the syllabus.For example the preparation of an entity’s financial statements could include matters relating to several accounting standards.

Questions may ask candidates to comment on the appropriateness or acceptability of management’s opinion or chosen accounting treatment.An understanding of accounting principles and concepts and how these are applied to practical examples will be tested.

Questions on topic areas that are also included in Paper F3 will be examined at an appropriately greater depth in this paper.

Candidates will be expected to have an appreciation of the need for specified accounting standards and why they have been issued.For detailed or complex standards,candidates need to be aware of their principles and key elements.

F8(2016.09-2017.06)

SUMMARY OF CHANGES

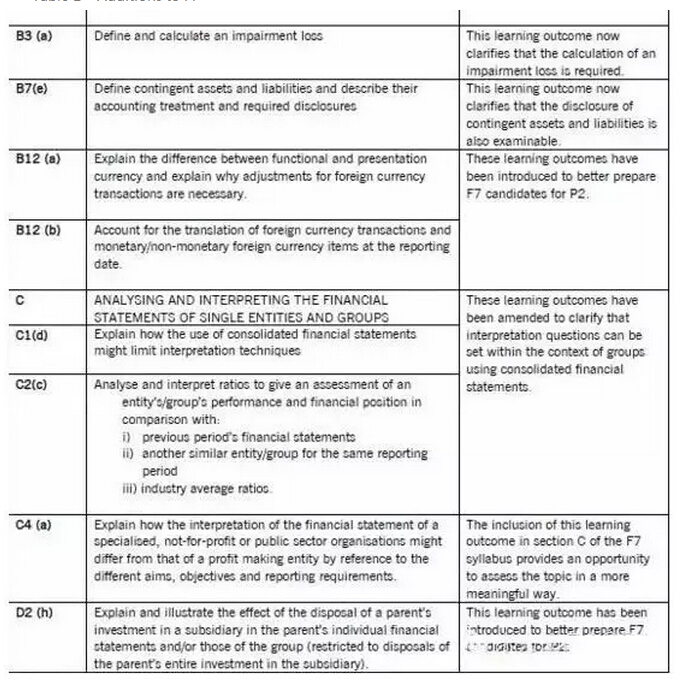

These syllabus changes are effective from September 2016 and will be updated with effect from 1st September each year,thereafter.

The main areas that have been changed in the syllabus are shown in the Table 1 below:

Table 1–Amendments to F8

Additionally the exam format will change in September 2016.Please refer to“Approach to examining the syllabus”in this document.

APPROACH TO EXAMINING THE SYLLABUS

The syllabus is assessed by a three-hour 15 minutes paper-based examination,All questions are compulsory.

Section A of the exam comprises three 10 mark case-based questions.Each case has five objective test questions worth 2 marks each.

Section B of the exam comprises one 30 mark question and two 20 mark questions.

Section B of the exam will predominantly examine one or more aspects of audit and assurance from planning and risk assessment,internal control or audit evidence,although topics from other syllabus areas may also be included.

F9(2016.09-2017.06)

SUMMARY OF CHANGES F9

Amendments/additions

There have been no amendments to the F9 study guide from the 2015–2016 study guide.

Additionally the exam format will change in September 2016.Please refer to“Approach to examining the syllabus”in this document.

APPROACH TO EXAMINING THE SYLLABUS

The syllabus is assessed by a three-hour 15 minutes paper-based examination,All questions are compulsory.

All questions are compulsory.It will contain both computational and discursive elements.

Some questions will adopt a scenario/case study approach.

Section A of the exam comprises 15 multiple choice questions of 2 marks each.

Section B of the exam comprises three scenarios consisting of 15 multiple choice questions of 2 marks each.

Section C contains two 20 mark questions.

The two 20 mark questions will mainly come from working capital management,investment appraisal and business finance areas of the syllabus.The section A and section B questions can cover any areas of the syllabus.

Candidates are provided with a formulae sheet and tables of discount and annuity factors.